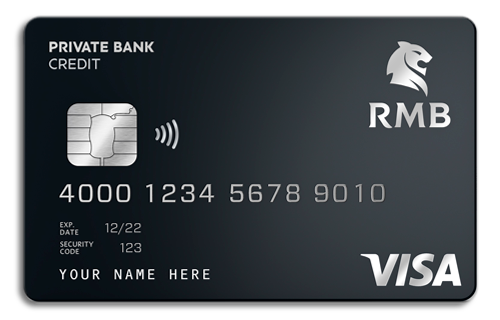

The RMB Private Credit Card offers a wide range of benefits and advantages to its holders. Enjoy the flexibility of worldwide shopping and personalized financial control to manage your spending effectively.

Accumulate rewards through the eBucks program with the RMB Private card. Earn points on everyday purchases and redeem them for various products and services, adding value to your spending.

Exclusive benefits include concierge services, travel insurance, and airport lounge access. The Card RMB Private ensures a premium experience. Keep reading to discover all the details and benefits that make this card a standout choice.

About the RMB:

RMB is a division of FirstRand Bank Limited, one of South Africa’s premier financial institutions. Founded to serve high-net-worth individuals, RMB offers specialized financial solutions, including wealth management, investments, and sophisticated banking services. Their mission is to provide personalized service and expert financial advice tailored to each client’s unique needs.

RMB combines advanced banking products with dedicated relationship management to help clients achieve their financial goals. By developing bespoke strategies and providing comprehensive offerings, RMB ensures a high level of support and guidance in wealth management.

Leveraging extensive expertise and resources, RMB delivers exceptional services such as exclusive credit cards, comprehensive insurance, diverse investment opportunities, and detailed financial planning. This approach guarantees that clients receive unparalleled support and personalized financial solutions, ensuring their wealth is managed effectively and efficiently. With a strong emphasis on building lasting relationships, RMB commits to understanding and addressing the specific financial aspirations of each client.

Card Benefits

eBucks Rewards: Earn up to 15% back in eBucks at selected stores and up to R8 per liter of fuel at Engen stations. This robust rewards program significantly enhances the value of everyday purchases, allowing you to save on groceries, fuel, and more.

Lounge Access: Enjoy up to 36 complimentary visits per year to SLOW and Bidvest lounges. This perk ensures a comfortable and exclusive travel experience, allowing you to relax and unwind in luxury while waiting for your flight.

Global Travel Insurance: Receive coverage of up to R5 million when you purchase round-trip travel tickets with your card. This extensive insurance plan offers peace of mind by protecting you against unforeseen travel emergencies, including medical expenses, trip cancellations, and lost luggage.

Concierge and Lifestyle Services: Benefit from a dedicated concierge service that assists with travel arrangements, restaurant bookings, event tickets, and other leisure activities. This service adds convenience to your life by handling the details, so you can enjoy your time more fully.

Card Security and Management: Features include the ability to temporarily lock and unlock your card, robust fraud protection, and contactless payments. These security measures ensure that your card is safe and easy to use, giving you control and confidence in your financial transactions.

RMB Private Bank Fees and Commissions

The RMB Private Credit Card has several associated fees. The monthly account fee is R325, with an additional credit facility service fee of R17. Cash withdrawal fees are R2.30 per R100 at FNB ATMs and R2.85 per R100 at other ATMs, making it important to consider these costs for frequent withdrawals.

Interest rates are based on the prime rate plus a margin determined by your credit profile. International transaction fees are 2.75% of the transaction value, and card replacements cost R140. These fees ensure comprehensive services and security for cardholders.

Please note that all fees and commissions are subject to change without prior notice. For the latest and most accurate information, visit the official site.

Positive points

- eBucks Rewards:Earn up to 15% back in eBucks at selected stores and up to R8 per liter on fuel at Engen, adding value to everyday purchases.

- Lounge Access:Up to 36 complimentary visits per year to SLOW and Bidvest lounges, enhancing the travel experience.

- Global Travel Insurance:Coverage up to R5 million, providing peace of mind during travels.

Negative points

- Monthly Fees:A monthly account fee of R325 and a credit facility service fee of R17, which can add up over time.

- International Transaction Fees:A fee of 2.75% on international transactions, which can be costly for frequent travelers.

- Card Replacement Fee:A R140 charge for replacing the card, which might be inconvenient if the card is lost or stolen.

Credit card limit

The credit limit for the RMB Private Credit Card is customized for each client based on their financial profile and credit assessment. This personalized approach ensures the credit limit meets the individual needs and circumstances of the cardholder, providing an efficient and tailored financial experience.

By considering factors such as income, credit history, and spending habits, RMB offers a limit that accurately reflects the client’s financial capacity, allowing for effective financial management.

How to apply for RMB Private

- Visit the Website: Go to the RMB Bank official website.

- Navigate to Credit Cards: Find the section for credit cards and select the RMB Private Credit Card.

- Check Eligibility: Ensure you meet the eligibility criteria, including income and credit requirements.

- Complete the Application: Fill out the online application form with your personal and financial details.

How to contact RMB

To contact the RMB you can call:

- Phone: +27 87 575 9411

- Email: [email protected]

Explore the RMB Private Credit Card today to unlock a world of exclusive benefits and financial freedom.